how to pay indiana state estimated taxes online

There is a 249 service charge because this is processed via third party. Use form ES-40 to pay Indiana state estimated quarterly taxes if applicable.

Irs Announced Federal Tax Filing And Payment Deadline Extension The Turbotax Blog

File your clients Individual Corporate and Composite Partnership extension in bulk.

. Fields marked with are required. Indiana Department of Revenue - DORpay. To pay a bill an estimated payment an extension payment or a payment for paper filed or electronically filed Corporation Income Tax andor Limited Entity Tax LLET return.

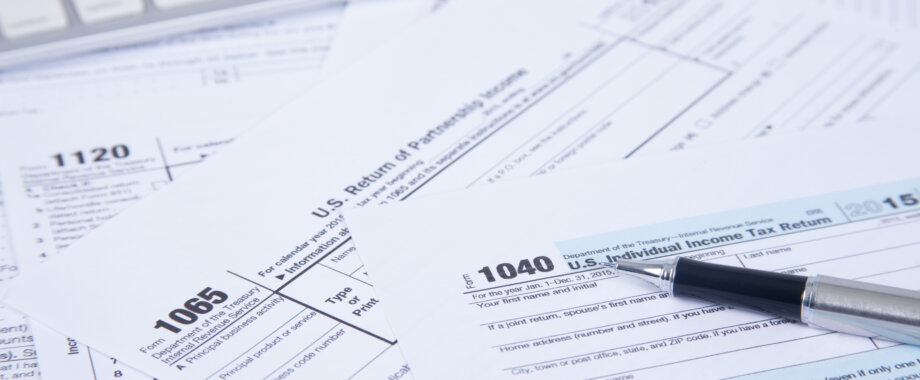

You may send estimated tax payments with Form 1040-ES by mail or you can pay online by phone or from your mobile device using the IRS2Go app. A penalty for failing to pay is imposed when the taxpayer doesnt pay the tax due on time. You can print other Indiana tax forms here.

Other Online Options Make a personal estimated payment - Form PV. Indygov Pay Your Property Taxes This service only accepts one-time full or partial payments made with ACHeCheck and Credit Card. Make a personal extension payment - Form PV.

You may send estimated tax payments with Form 1040-ES by mail or you can pay online by phone or from your mobile device using the IRS2Go app. Use form ES-40 to pay Indiana state estimated quarterly taxes if applicable. You do not need to create an INTIME logon to make a payment.

An INTIME Functionality chart listed by tax type is available. The Indiana Department of Revenues DOR e-services portal the Indiana Taxpayer Information Management Engine INTIME enables customers to manage business taxes withholding corporate income tax and individual income tax in one convenient location 247. Select the Make a Payment link under the Payments tile.

Indiana State Tax Information Support Payment of estimated taxes Estimated payments can be made by one of the following methods. Find out when all state tax returns are due. Make a Bill Payment Without Logging in to INTIME.

You can download or print current or past-year PDFs of Form ES-40 directly from TaxFormFinder. Failure to file or pay Estimated Taxes. Pay online quickly and easily using your checking or savings account bankACHno fees or your debitcredit card fees apply through INTIME DORs e-services portal.

Individuals and businesses can make estimated tax payments electronically through MassTaxConnect. File returns and make payments. Step-by-step guides are available.

MyTax Illinois If you have an MyTax Illinois account click here and log in. INTIME provides access to manage and pay individual income and various corporate and business tax obligations. Estimated payments may also be made online through Indianas INTIME website.

If you dont already have a MyTax Illinois account click here. If you owe 1000 or more in state and county tax thats not covered by withholding taxes or if not enough tax was withheld you need to be making estimated tax payments. View history of payments filed via this system.

Online Payment Application Options Make a bill payment. Check or money order follow the payment instructions on the form or voucher associated with your filing. Access INTIME at intimedoringov.

Select Individual Payment Type and select Next. Choose to pay directly from your bank account or by. Make a credit card payment.

It amounts to 5 the tax due per month and cant exceed 50 of the total tax due. Follow the links to select Payment type. Review your payment and select Submit.

However if you owe Taxes and dont pay on. Under Quick Links select Make a Payment. Access INTIME at intimedoringov.

15 the total tax due per month. Choose the amount you want to pay and your payment method and select Next. For additional information refer to Publication 505 Tax Withholding and Estimated Tax.

Access your account online. There is no online option at this time for Forms IT-2658 Report of Estimated Tax for Nonresident Individual Partners and Shareholders or CT-2658 Report of Estimated Tax for Corporate. See INTIME user guides.

Once logged-in go to the Summary tab and locate the Make a payment hyperlink in the Account panel. Online applications to register a business. Before making an Income quarterly estimated payment calculate online with the Quarterly Estimated Tax Calculator.

If you did make estimated tax payments either they were not paid on time or. Here are your payment options. To make an estimated tax payment online log on to wwwingovdor4340htm.

Visit IRSgovpayments to view all the options. To make an individual estimated tax payment electronically without logging in to INTIME. In addition extension return and bill payments can also be made.

Follow the links to select Payment type enter your information and make your payment. We last updated the Estimated Tax Payment Voucher in January 2022 so this is the latest version of Form ES-40 fully updated for tax year 2021. Make an estimated income tax payment through our website You can pay directly from your preferred account or by credit card through your Online Services account.

The Indiana Taxpayer Information Management Engine known as INTIME is the Indiana Department of Revenues DOR e-services portal. Enter your SSN or ITIN and phone number choose the type of tax payment you want to make and select Next. Its fast easy and secure.

Tax Refund Estimator Calculator For 2021 Return In 2022

Indiana Paycheck Calculator Smartasset

How Taxes On Property Owned In Another State Work For 2022

Income General Information Department Of Taxation

Irs Announced Federal Tax Filing And Payment Deadline Extension The Turbotax Blog

The Owner Operator S Quick Guide To Taxes Truckstop Com

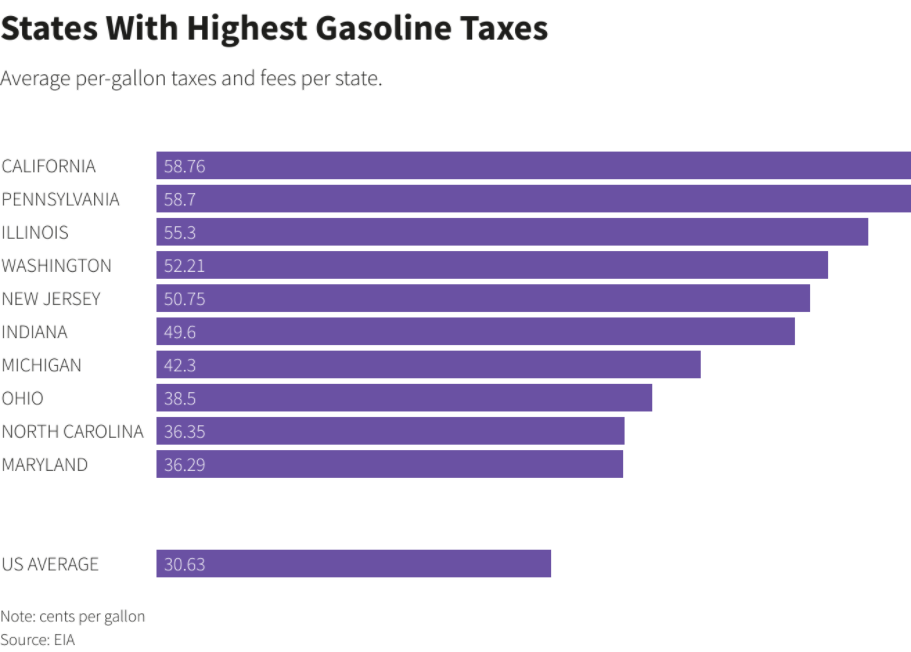

Explainer U S Gasoline Prices Could Fall Below 3 If Oil Market Sustains Losses Reuters

What Is A Cp30 Irs Notice Jackson Hewitt

Employer Withholding Department Of Taxation

Irs Announced Federal Tax Filing And Payment Deadline Extension The Turbotax Blog

What If You Haven T Paid Quarterly Taxes Mybanktracker

2022 Sui Tax Rates In A Post Covid World Workforce Wise Blog

Free Retainer Agreement Template Sample Pdf Word Eforms

Irs Announced Federal Tax Filing And Payment Deadline Extension The Turbotax Blog