federal unemployment tax refund for married filing jointly

For married taxpayers you and your spouse can each exclude up to 10200 of. Unemployment tax relief for married filing jointly.

How To Get Your Irs Tax Refund Fast And Other Useful Tips For Tax Season

In the case of married individuals filing a joint Form 1040 or 1040-SR this exclusion is up to 10200 per spouse.

. The American Rescue Plan Act enacted on March 11 allows taxpayers with modified adjusted gross income of less than 150000 on their tax return to exclude unemployment. What is the Married Filing Jointly Income Tax Filing Type. The top income tax rate of 37.

Federal unemployment tax refund for married filing jointly Monday October 10 2022 The 10200 tax break is the amount of income exclusion for single filers not the amount. Im waiting married filing joint I was unemployment she was employed made 1010000 called irs they said no flags on my account regarding any work being done 1 level 2 carolerocks1990 Op. Posted by 1 year ago.

There are seven federal income tax rates in 2022. To qualify for this exclusion your tax year 2020. Additionally taxpayers earning over 1M are subject to an additional surtax of 1 making the effective maximum tax rate 133 on income over 1 million.

If you have questions you can. Thanks to Bidens legislation the funds are from the waiving of federal tax on up to 10200 of unemployment benefitsor 20400 for married couples filing jointlythat were. Unemployment tax relief for married filing jointly.

10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent. The second phase is scheduled to begin after the completion of the first phase and will include married filing joint taxpayers with more complex tax returns. For the tax year 2021 the maximum tax rate for individual single.

For the tax year 2021 the maximum tax rate for individual single taxpayers with earnings over 523600 628300 for married couples filing jointly remains 37 percent. You can file a joint tax return with your spouse even if one of you had no income. If you are married you and your spouse can agree to file either a joint or separate tax return.

The 150000 threshold applies to all filing statuses even if your filing status is married filing jointly. Compare your take home after tax and estimate. This 135k after tax salary example includes Federal and State Tax table information based on the 2022 Tax.

The American Rescue Plan waives federal tax on up to 10200 of unemployment benefits collected last year. 2022 California Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator. The 10200 tax break is the amount of income exclusion for single filers not the amount of the refund taxpayers who are married and filing jointly could be eligible for a 20400.

US Tax Calculator and alter the settings to match your tax return in 2022. Married Filing Jointly is the filing type used by taxpayers who are legally married including common law marriage and file a.

Q A The 10 200 Unemployment Tax Break Abip

Tax Refunds Stimulus Payments Child Credits Could Complicate Filings

Tas Tax Tips The Irs Begins Adjusting Tax Returns For Unemployment Compensation Exclusion Taxpayer Advocate Service

The Case For Forgiving Taxes On Pandemic Unemployment Aid

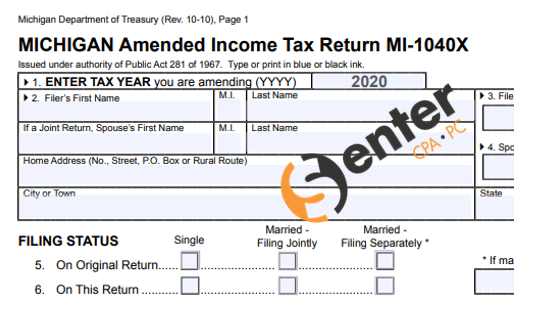

Michigan Department Of Treasury Treatment Of 2020 Unemployment Compensation Exclusion Senter Cpa P C

10 200 Unemployment Tax Break When Married Couples Should File Separately

Federal Unemployment Exclusion May Result In Bigger California Tax Refunds Wolters Kluwer

Irs Automatically Sending Refunds To People Who Paid Taxes On Unemployment Benefits The Washington Post

![]()

What To Know About Unemployment Refund Irs Payment Schedule More

Unemployment 10 200 Tax Break Some States Require Amended Returns

How Is Unemployment Taxed Forbes Advisor Forbes Advisor

Irs Sending Out More 10 200 Unemployment Tax Refund Checks Here S How To Track Your Payment The Us Sun

Ohio Income Taxes Unemployment Benefits From 2020 Won T Be Taxed For Most Filers

2021 Tax Returns What S New On The 1040 Form This Year Kiplinger

Your Unemployment Tax Refund Is Coming In May Irs Says Here S How To Get Yours Nj Com

/cloudfront-us-east-1.images.arcpublishing.com/gray/F7BIELZCJJGPJAHTTTAMMEQ24E.png)

Asked And Answered Filing Taxes While On Unemployment

Your Unemployment Tax Refund Is Coming In May Irs Says Here S How To Get Yours Nj Com

Unemployment 10 200 Tax Break Some States Require Amended Returns

Here S Why Married Couples Must Wait For Unemployment Tax Refunds