capital gains tax usa

Source capital gains in the hands of nonresident alien individuals physically present in the United States for 183 days or more during the taxable year. Short-Term Capital Gains vs Long Term.

Short Term And Long Term Capital Gains Tax Rates By Income

This usually happens from the sale of an.

. There is a 28 capital gains tax on capital gains made from selling collectible assets including art antiques precious metals stamp collections jewelry coins and other. Short-term capital gain tax rates. State Taxes on Capital Gains.

Which capital gains tax rate applies to 2023 long-term gains will depend on your taxable income. Long-term gains are taxed at lower rates up to 20 percent. A flat tax of 30 percent is imposed on US.

At the state level income taxes on capital gains vary from 0 percent to. 2022 federal capital gains tax rates. Short-term capital gains are taxed as ordinary income at rates up to 37 percent.

For example a single person with a total short-term capital gain of. Most long-term capital gains are taxed at rates of 15 or less. Long-term capital gains are taxed at lower rates than ordinary income while short-term capital gains are taxed as ordinary income.

Most states tax capital gains according to the same tax rates they use for regular income. So if youre lucky. As part of this there is a long-term capital gains tax which is a 20 tax on investments held for more than.

Taxpayers with modified adjusted gross income. For example a single person with a total short-term capital gain of 15000 would pay. Short-term capital gains are gains apply to assets or property you held for one year or less.

The amount taxed for capital gains depends on the income of the taxpayer and their filing status. If your capital losses exceed your capital gains the amount of the excess loss that you can claim to lower your income is the lesser of 3000 1500 if married filing separately. 250000 of capital gains on real estate if youre single.

You must report all 1099-B transactions on Schedule D Form 1040 Capital Gains and Losses and you may need to use Form 8949 Sales and Other Dispositions of Capital. Your tax rate is 15 on long-term capital gains if youre a single filer earning between 40401 and 445850 married filing jointly earning between 80801 and 501600 or. The capital gains tax on most net gains is no more than 15 for most people.

Capital gains tax USA property occurs when an asset is sold for more than what was paid to acquire it. Capital gains taxes on assets held for one year or. Australia Wont Stop Charging Capital Gains Tax on Crypto.

2022 capital gains tax calculator. The capital gains tax rate is 0 15 or 20 on most assets held for more than one year. Capital Gains Tax Calculator and Rates 2022-2023.

If your taxable income is less than 80000 some or all of your net gain may even be taxed at 0. Weve got all the 2021 and 2022 capital gains. They are subject to ordinary income tax rates meaning theyre.

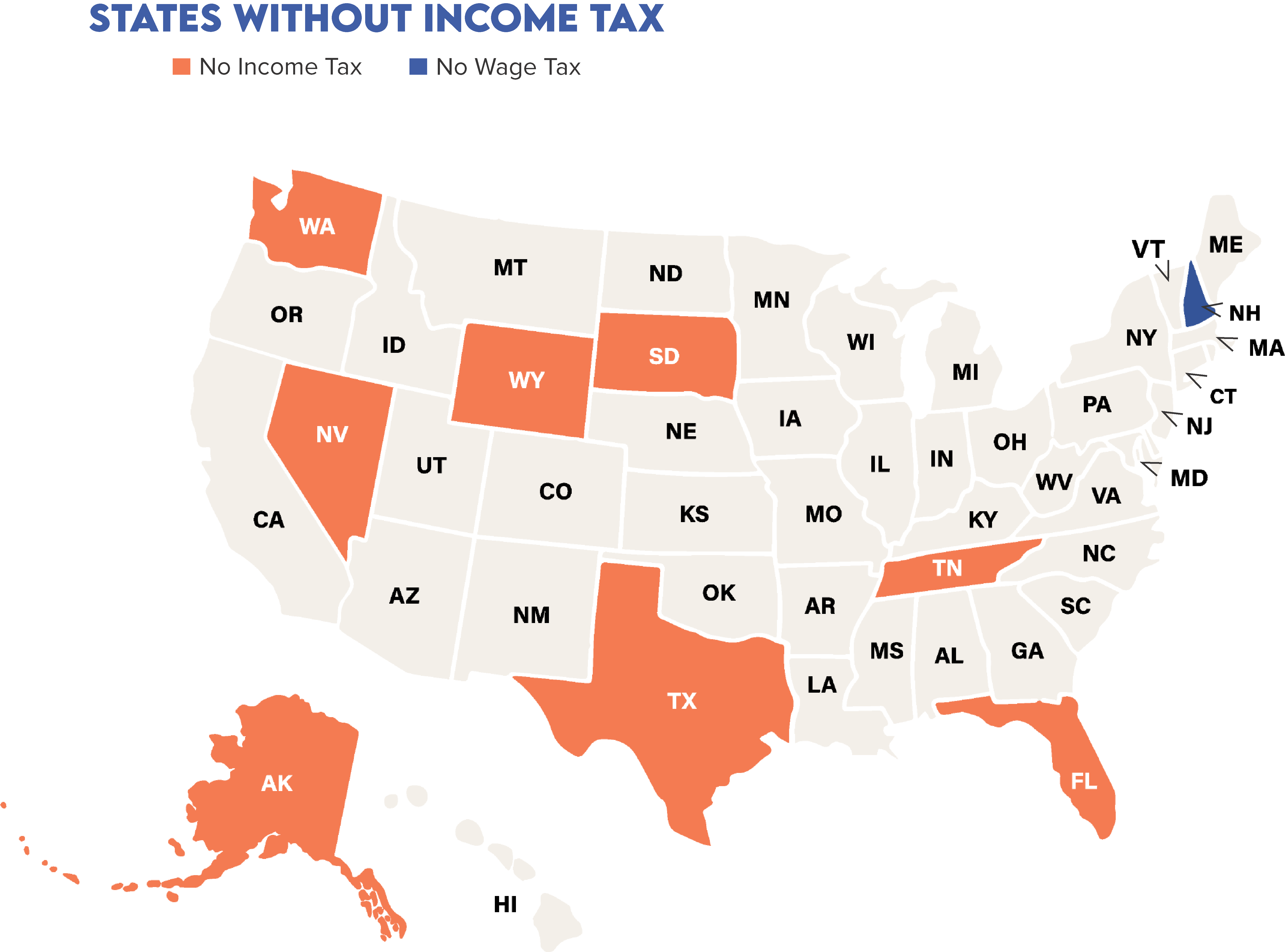

The highest-earning people in the United States pay a 238 tax on capital gains. If you sell stocks mutual funds or other capital assets that you held for at. In addition to federal taxes on capital gains most states levy income taxes that apply to capital gains.

The IRS typically allows you to exclude up to. Just like income tax youll pay a tiered tax rate on your capital gains. 500000 of capital gains on real estate if youre married and filing jointly.

Some states also levy taxes on capital gains.

What You Need To Know About Capital Gains Tax

29 Best Capital Gains Tax Ideas Capital Gains Tax Capital Gain Tax

Capital Gains Tax Under The American Families Plan Marcum Llp Accountants And Advisors

2022 Income Tax Brackets And The New Ideal Income

What You Need To Know About Capital Gains Tax

Legislation Proposed In U S Would End Capital Gains Tax On Bitcoin Purchases Under 600

Are Capital Gains Taxes Irrelevant Tino Sanandaji

The Irs Taxes Crypto For U S Expats Investments For Expats

Substantial Income Of Wealthy Households Escapes Annual Taxation Or Enjoys Special Tax Breaks Center On Budget And Policy Priorities

How High Are Capital Gains Taxes In Your State Tax Foundation

Elimination Of Stepped Up Basis Poses Hazards To Family Farms

Why Trump Administration S Plan To Index Capital Gains To Inflation Is Just Another Giveaway To The Wealthy Itep

Biden To Propose Capital Gains Tax Of 39 6 On Investors Earning 1m Or More Marketplace

A Beginner S Guide To Filing Cryptocurrency Taxes In The Us Uk And Germany

How Low Are U S Taxes Compared To Other Countries Tax Rate Capital Gains Tax Us Tax

The Flight To Tax Free States Investor Tax Advantages

How Do Short Term Capital Gains Work Vs Long Term Capital Gains Quora